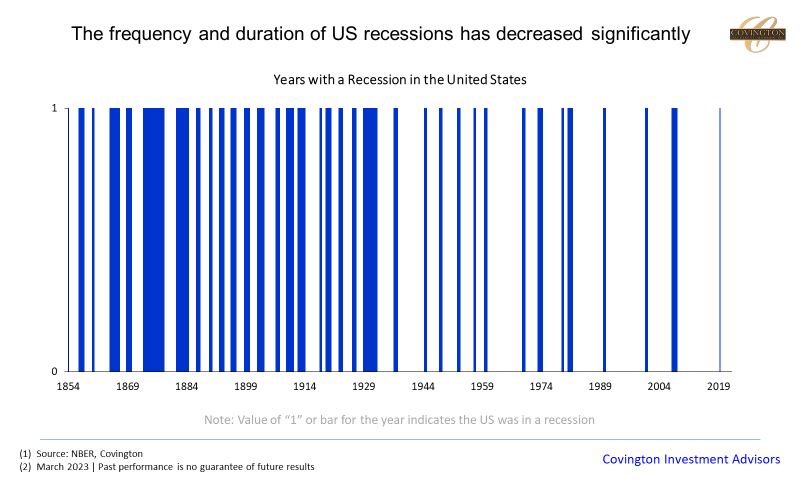

150 Years of US Recessions

Not a barcode… Today's chart plots the frequency and duration of every post-Civil War recession in the United States. If the year has a blue bar that indicates the US economy was in a recession or decline in business activity for the period.

As the Fed embarks on their capital tightening cycle to tame inflation we are likely nearing the end of this expansion pointing to perhaps one of these blue bars appearing in the next 6-12 months. In past notes we have hinted at the likelihood of this occurring and what it would mean for asset prices and long term investment portfolios. See here, and here.

But the intention behind today's chart is to show the frequency of these contractions in the context of an ultra-long time horizon. The consensus amongst economists today is that we will have a recession later this year but it will be “short and shallow” due to the strong labor market, resilient consumer, and mild household leverage. This might be true although I would say predicting the timing, let alone characteristics of a recession are very difficult. But the short & shallow camp has the trend of history on its side. As apparent in today's chart, the bars (recessions) are much more persistent and wider in the pre-1930s segment and then begin to wither and narrow up to the most recent recession beginning in March of 2020 that lasted only two months. What's interesting is that this transition from a boom/bust economy to one with less frequent and shorter economic contractions correlates with the charter of the Federal Reserve (1913) and pioneering of monetary easing techniques (1970s).

The Federal Reserve has been in the mainstream spotlight in recent years beginning with its role in the unprecedented stimulus in 2020 and now the withdrawal of said stimulus to tame inflation. In that timeframe the central bank has received its fair share of criticism but the chart today would play some devil's advocate to that indicating that the Fed has largely been successful at lengthening economic expansions while shortening economic contractions.

Of course there are a myriad of other factors that have contributed to the decreasing frequency and duration of recessions over time. Policymakers across the board, not just central bankers, have become more adept at using monetary policy to stabilize the economy, and governments have become more willing to use fiscal policy to stimulate the economy during recessions. This has helped to shorten the duration of recessions and make them less severe. The 2020 recession really illustrates this although it may also show the longer term consequences of excessive stimulus. The global economy has also become more integrated which some theorize lessens the cyclicality of any one single economy.

So, as we progress through this year the economy will remain in a transitory state until the Federal Reserve achieves its goal of tamping down inflation. Once that is achieved, with or without a recession, monetary policy will be need to be eased so the economy can begin the next growth cycle.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.