The Big Get Bigger

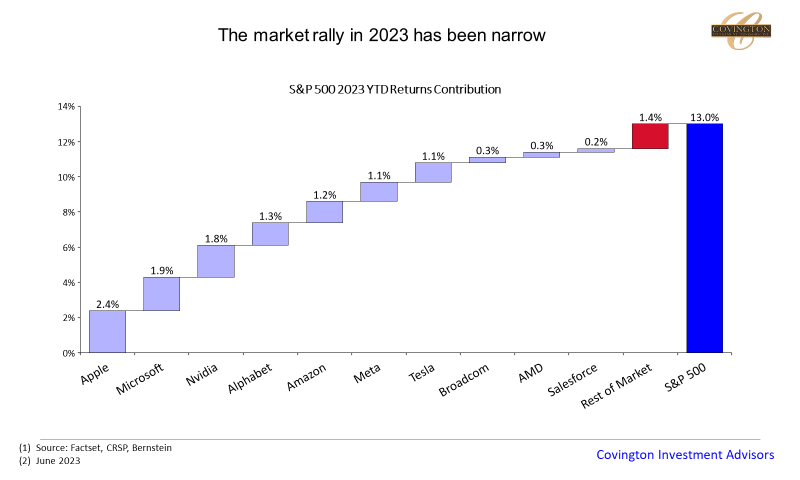

The first half of 2023 has felt very similar to the tumultuous years of 2020 and 2021 which saw the market dominated by mega-cap tech stocks. The average YTD return on Amazon, Apple, Google, Meta (Facebook), Microsoft, Nvidia, and Tesla is 84%. The average YTD return for the rest of the S&P 500 is just 3.7%. In fact, when breaking down the contribution to the index’s total year-to-date returns this chasm becomes even more apparent – ten stocks contribute all but 1.4% of the returns which is shown in today's chart above. This is the most narrow breadth in the market since the tech bubble in the early 2000’s.

What's driving this? A lot of it is optimism over the proliferation of artificial intelligence (AI) and multiple expansion for the previously listed top ten stocks. Many of these are now priced at or near the top end of their historical valuation range which is puzzling considering those previous highs were when interest rates were near 0%. For Meta and Nvidia, sharply increased earnings expectations are also part of the explanation for their meteoric rise this year. For the other five stocks mentioned in the first paragraph of this note, earnings expectations are either flat, or in the case of Tesla projected to fall due to $2k-$10k price cuts for the Model Y, S, and X vehicles (which hasn't prevented Tesla from rising by over 90% in 2023).

Past episodes where the market has become very concentrated and returns driven by only a handful of names have been cause for concern to investors. In 1990, the top 10 companies in the S&P 500 accounted for 12.3% of the index's value. Today the top 10 companies account for 35% of the index's value. In 2000 and 2022 concentrated positions and elevated multiples destabilized markets particularly in the growth part of equities. The concentration of the S&P 500 has a number of implications for investors. First, it means that investors are more exposed to the performance of a few large companies. This can make the S&P 500 more volatile, as the performance of a few large companies can have a significant impact on the index's performance. Second, it means that investors are less diversified than they would be if the index were more evenly distributed. This can increase the risk of their portfolios. The counterpoint to this is that market rallies starting with just a handful of names is not unusual. Many sustained market rallies have started with a small subset of companies but have then broadened out across markets and geographies. What’s more is that today’s technology companies produce more cash and are for the most part fundamentally stronger than their counterparts in the early 2000s. Still, most of this is already recognized by the market and a broadening out of the rally and rationalization of expectations in the technology space will be needed at some point.

While we think the multiples and hype in the technology sector have probably gotten extended, a more resilient economy and easing central bank policy warrants at least some respite in markets… However, not abandoning key fundamental analysis in such a narrow market concentration in the investment process is crucial to long term success and anticipating the next rotation by having exposure to dividend, small cap, and value is the prudent approach at this stage.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.