2024 Holiday Economic FAQs

It’s hard to believe that 2024 is already coming to a close and it’s time to gather with family and look forward to the new year. We know social conversation topics are wide ranging but none are as exciting as economics and investing. So, if the economy or markets come up over your holiday festivities we have you covered with our viewpoint on a handful of current topics. For each question we provide both a short and long answer depending on if the topic comes up over dinner or dessert. Our 2023 edition of this note can be found here.

- How will the new Trump Administration affect the stock market?

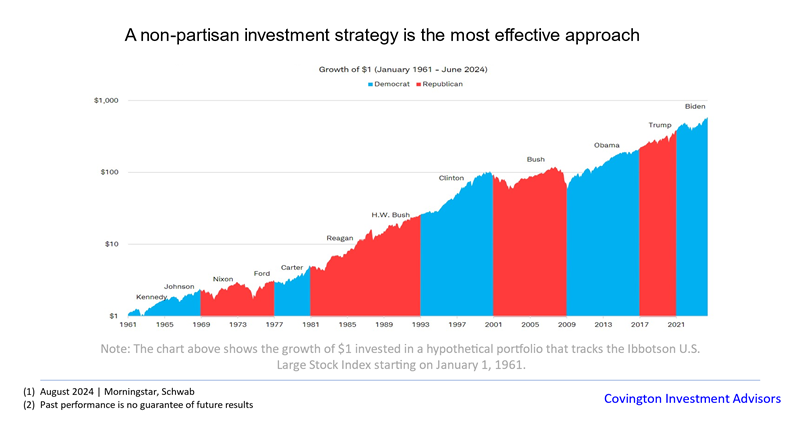

Short answer: Presidential regimes tend to not have as much impact on the stock market as many believe. The overall strength of the economy and earnings cycle is what dictates market performance.

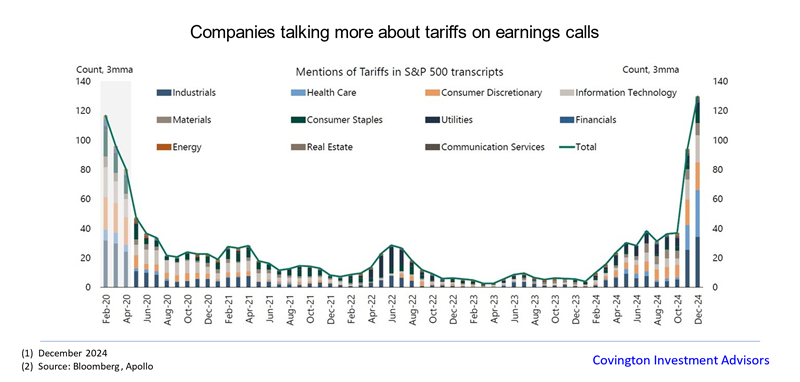

Long Answer:We have always emphasized that the best long term investment strategy is to take a non-partisan approach that doesn’t get clouded by political biases. The incoming Trump administration is touting a wide range of bold proposals including high tariffs, tax cuts, immigration reform, and deregulation. Energy policy was also a point of emphasis during the campaign, with Trump distilling his energy policy down to the phrase “drill baby drill”. Optimism over these policies have spurred a strong year-end rally in US equities. But it's important to remember that what is said on the campaign trail is not always the same as what's able to be enacted. And once enacted how much does it affect the long-term trend of corporate earnings in a dynamic $30 trillion economy? Likely not as much as headlines would have you think.

So President-elect Trump has several potentially conflicting economic policy goals, and how he weighs them in office will determine their effect on global growth and asset prices in 2025. One thing I do feel confident predicting is that a changing presidential administration and new political developments will create plenty of noise in markets. Once again, the best approach is to keep a long-term, non-partisan view to investments and ignore the noise.

- It's been another great year in markets. Can we expect the same in 2025?

Short answer: It’s impossible to predict the year-to-year fluctuations of the market, but future returns are likely to be more modest.

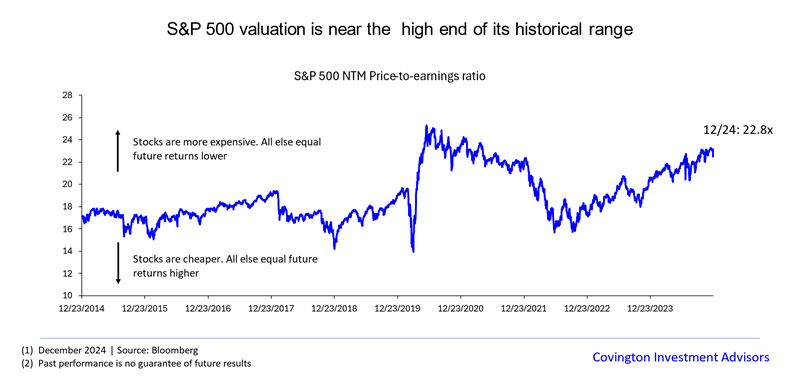

Long answer: As of writing this, there are four trading days left in 2024 and it appears we are going to finish with back to back years of 20%+ returns in the S&P 500 which is pretty remarkable. Stock market growth cycles can last several years, but a recalibration to trend line historical returns would be warranted.

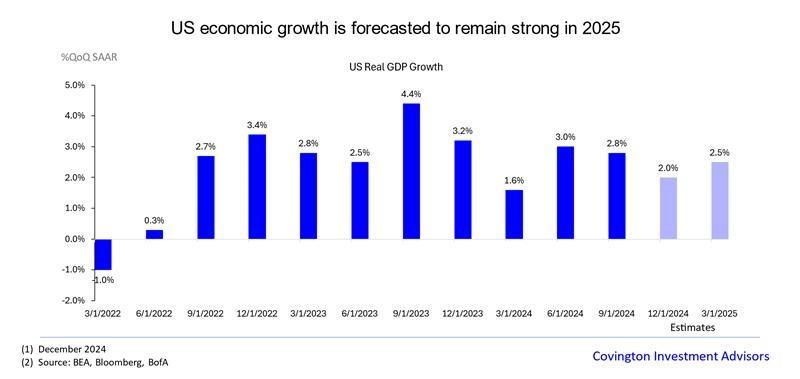

I am going to recycle some of my answer to a similar question from last year and say that I think future returns will be more modest than they have been in the recent past. The reasoning for this is that stock valuations are elevated, the fiscal boost has come from deficit spending, and hurdles for the growth stocks of the market will be high in 2025. However, the fundamentals of the economy are still strong and pretty much the same as they were last year pointing to an economy that is cooling, but not cold. The last two years we have been spoiled with very strong returns and low volatility in equity markets which tends to be the exception, not the norm. Corporate earnings are projected to grow 12% in 2025 which if materializes would point to a strong equity market. Federal Reserve policy also remains accommodative, even if expectations for the number of rate cuts in 2025 has been recalibrated in the last month. As of right now the bottom line is unemployment is low, economic and corporate earnings growth is strong, and central bank policy is easing - that is not a bad formula for equities.

Now again, I said pretty much the same thing 12 months ago, and the market ended up defying predictions with a very strong year. But I think expectations should be tempered from here and as always we need to be prepared for a correction in equity markets. We will check back in on this in next year's FAQ.

- Is the US fiscal outlook sustainable?

Short answer: The current US debt level is not cataclysmic. But the fiscal deficit path is not sustainable, and a growing debt load will slow down economic growth

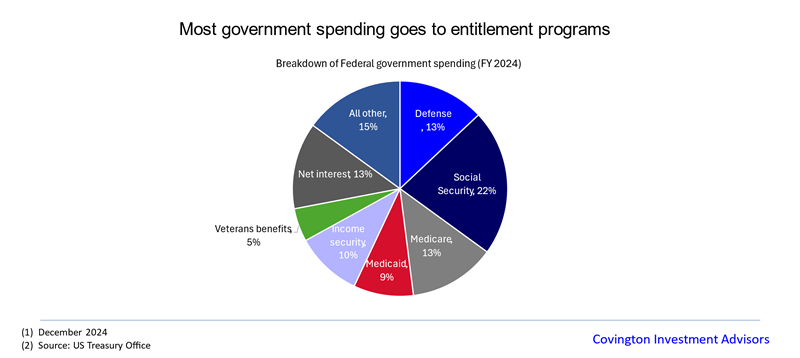

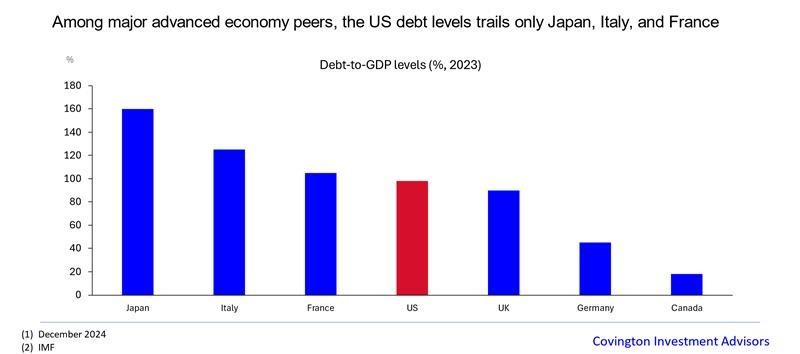

Long Answer: A sustainable fiscal path is traditionally viewed as one where the ratio of public debt-to GDP is not rising, which is not today’s situation. Public marketable debt-to-GDP rose by 1.8pp last year to 98%, and it should rise above 100% of GDP in the coming years given deficit forecasts.

As debt levels rise many think the consequence is a debt crisis or some cataclysmic default but the consequence is usually something less dramatic but still harmful - lower growth. Economic research finds high debt levels are associated with lower growth rates but estimates of the debt-to-GDP threshold that would trigger an adverse effect on growth are wide. For example, Reinhart and Rogoff (2010) found public debt levels above 90% result in weaker growth when looking at a broad basket of countries. An example of this transpiring is Japan which has maintained much higher levels of debt-to-GDP for decades without a debt crisis but has experienced anemic economic growth. There are several key differences that make it a questionable model for the US, but the underlying message is that higher debt levels, if not invested in GDP growing functions eventually slows down growth.

- Will artificial intelligence take over the world in 2025?

Short answer: I don't think it will take over the world, but AI is showing signs of being a productive technology for the US. However, growth hurdles are high for AI stocks and returns will be more selective.

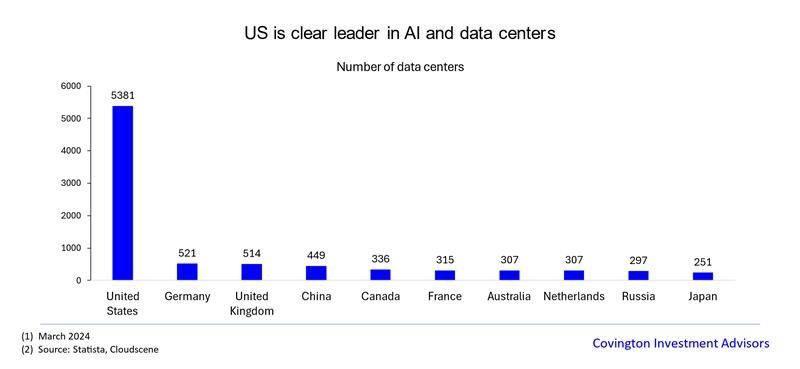

Long Answer: The beginning of the AI boom is largely attributed to the release of large language models like GPT-3 and its successors, culminating in the highly publicized launch of ChatGPT in late 2022. Since then, there has been an arms race by technology companies to develop their own AI models and the infrastructure to service them. The biggest winner of this rush has been Nvidia (NVDA), which makes the highly sophisticated GPU chips that process data to train these models - but just about any company with exposure to the AI value chain experienced a bump in demand and stock price.

This dynamic has lasted for two years with companies jockeying for leadership position. But up to this point, the bulk of the economic profits from AI have accrued to the technological enablers such as the semiconductors, server equipment manufacturers, and cloud providers rather than the companies offering AI products to consumers. In other words, a lot of money is being made in the kitchen, but not much in the dining room. I think the next phase in AI development will have to be companies providing ubiquitous and profitable AI applications for everyday consumers. There is likely to be some turbulence to this process, as there always are in technology adoptions and the hurdle for growth companies will need to see from their investment is high.

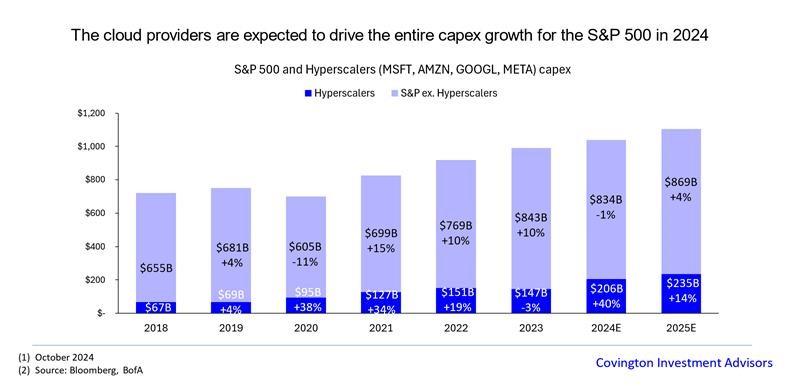

Overall AI has been a fantastic growth lever for the US economy, and capital spending in the technology sector is forecasted to remain strong for the next two years. Almost the entirety of the S&P 500s capex growth in 2024 will be attributed to the cloud hyperscalers (AMZN, MSFT, GOOG). What’s more, a large chunk of this capex is being spent on long-lived assets such as data centers and energy infrastructure.

- Will geopolitics be disruptive to markets in 2025?

Short answer: It's possible - but basing investment decisions on geopolitics is typically a poor decision. It's better to construct a portfolio of high quality investments that can weather a possible geopolitical disruption.

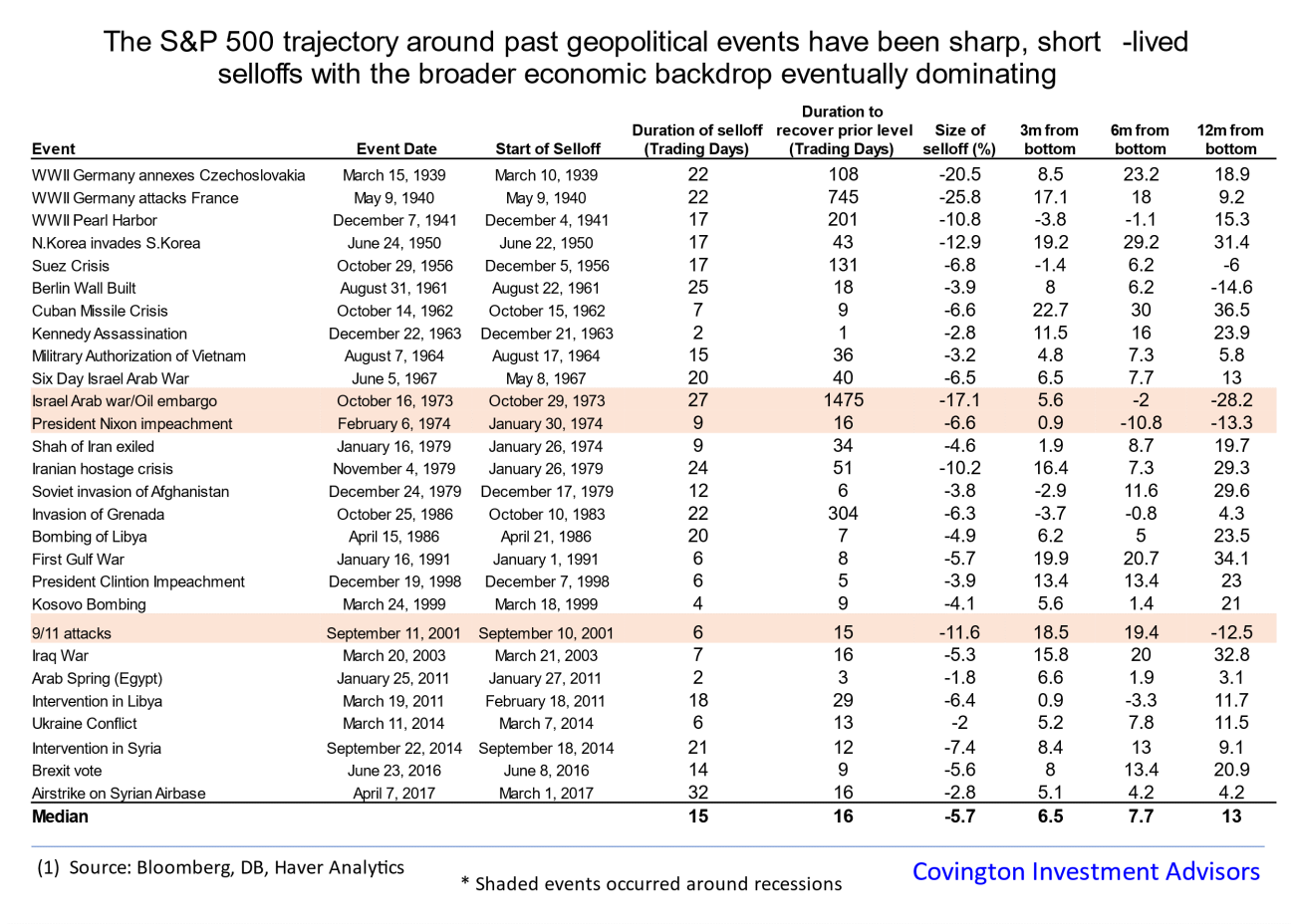

Long answer: Geopolitical events by their nature are difficult to predict and tend to be short lived, although there are certainly exceptions. When looking back at historical geopolitical shocks what we have found is they have rarely left a deep scar on markets and it is ultimately the underlying economic context that often ends up driving the response.

It's entirely possible the current conflicts could escalate or a new one could emerge. However, basing investment decisions purely on geopolitical risks is typically not successful. The last two years are a great example as the ongoing conflicts caused energy and trade disruptions that resulted in short periods of volatility in markets – yet, the S&P 500 still rose over 20% the last two years. The best approach is to stay vigilant for possible risks and construct a portfolio of durable assets that can withstand exogenous shocks.

- Cousin Timmy is up big on his Bitcoin holdings. Should I sell all my investments and buy crypto?

Short Answer: I don't think that would be prudent.

Long Answer: For the most part we try to avoid the discourse around cryptocurrencies, as we view them as a purely speculative vehicle rather than an investment one. However, in the holiday spirit I will end this note on a topic that is likely to stir the most controversy and create the liveliest conversation.

Cryptocurrencies, in my opinion, are essentially a massive speculation scheme wrapped in a faux technology/payment network. And that’s fine - you can make money speculating- just the same as you can turn a profit going to Vegas and “investing” money into a slot machine. But you can also lose a lot of money doing both. When financial markets are strong crypto provides a leveraged and gamified vehicle to capitalize on investor risk appetite. But it’s dangerous to confuse speculating for investing. The entire thesis of crypto from an investment standpoint revolves around buying it with the hopes of selling it to someone else at a higher price- who is then hoping to do the same thing.

Why isn't a stock the same thing? A stock has intrinsic dollar value because it represents a claim on the earnings produced by a tangible entity. That tangible entity is a corporation that (should) earn a profit thus producing cash flow that can be forecasted and distributed to shareholders - the most common distribution form is a cash dividend. As an extremely simplified example: If you purchased a share of Coca-Cola today and the stock market closed forever, that security still has value even if you could never sell it. This is because Coca Cola through its enterprise of selling soft drinks, produces roughly $10 billion of free cash flow every year which you as a shareholder have claim to your own proportionate sliver of that $10B. You will receive a dividend check as long as the company remains strong and profitable. It’s the same reason cash flowing real estate has intrinsic value. The price may fluctuate with the market depending on investor sentiment and changing forecasts, but there is an underlying utility and fundamental to it.

There are also two sides of the investing equation: Risk and return. When markets are at all-time highs and risk appetite is fraught it's easy to focus on the return part of the equation and ignore the risk side. But in a market correction - or even worse a recession - risk happens fast. And to us, protecting downside risk is just as crucial as producing upside returns. What happens to crypto in a recession? Bitcoin was invented in 2009. Its entire existence has been during one of the strongest financial market cycles of all time. What happens when the economy goes through a prolonged recession? Stock prices will surely correct in a recession, but good companies will still produce cash flow for investors during these tough periods. Stocks have a hundred year track record of weathering market cycles and derive their value from the productive capabilities of the US economy. What will happen to crypto prices when the speculative mania turns into panic selling and there’s no underlying cash flow to warrant buying it? Caution is usually warranted when an investment thesis revolves around groupthink and the necessity to find more marginable buyers. In the 17th century, Dutch speculators were paying the equivalent of the cost of a mansion for tulip bulbs.

The topic of crypto could take up a whole dissertation by itself, but I hope this brief viewpoint stirs some controversy - clearly, it even makes a lively topic to write about. We will have to check back in our future Holiday FAQs to see if I am vindicated or proven wrong! For now, we will stick to our proven investment philosophy of owning high quality, profitable companies that are trading at a reasonable price – and allowing those investments to compound over long periods of time.

As always, we hope this piece helps answer some of your questions but also maybe provides some topical materials for those lively holiday debates. We hope you have a Merry Christmas and a Happy Holidays, we look forward to seeing you all in 2025!