How Has Wall Street’s Latest Innovation Helped You Lately?

Whatever happened to prudent investing? For decades successful investors focused on companies with proven earnings, reliable cash flow, and durable competitive advantages. Yet in recent years, that philosophy has been overshadowed by Wall Street’s latest “innovations.”

Wall Street and its ever-growing pool of brokers love trends. They love creating them and more importantly, they love selling them to you. Products designed to sound sophisticated, safe, and opportunity filled. Among the most recent of these are Buffered Exchange-Traded Funds (ETFs). The investment sounds appealing on paper, however as you will come to see, because of their design, they will often fall short of their pitch.

Buffered ETF’s: Understanding the Pitch

The pitch goes something like this, have you ever wanted market exposure, while limiting your downside potential? While now you can have it with this Buffered ETF.

Sounds savvy and more importantly it sounds safe, and the pitch is loud, with The Daily Upside reporting that 27% of all new ETF listings in 2024 were buffered ETFs. Protection from downside risk seems nice in a market that is seeing an uptick in volatility, however, take a closer look and you will see why this product underdelivers.

For starters let it be known that while the performance of these funds is dependent on stock movements, it is not necessarily a stock fund. Generally, these funds are invested in options contracts on a benchmark index ETF (commonly the S&P 500). These derivative structures define both the protection “buffer” and a maximum return cap. For instance, the “FT vest U.S Equity Buffer ETF- December fund” (FDEC), according to its summary prospectus it protects “against the first 10% of Underlying ETF losses” and has a “predetermined upside cap of 14.76%.”

That’s a burdensome provision in a market that is already up 18.38% YTD as of 10/29/2025, meaning that an investor in FDEC would have already missed nearly 4% of the market’s return potential - with just over two months still left in the year. Over a three-year horizon where the market is up 22.69%, that cap translates to an even greater opportunity cost of roughly 8% in foregone gains.

The trade-off: Paying More for Less

Proponents argue that buffered ETFs are valuable hedges in volatile markets, limiting downside exposure when corrections occur. However, investors should consider that even with a 10% downside buffer, they remain exposed to losses beyond that threshold- and those missed gains over time can far outweigh the protection during downturns.

The costs do not stop there, as the options used to create these funds are expensive and as such are passed along to the investor through higher expense ratios, which according to Kiplinger, come in at an average cost of 0.78% per year. For a reference comparison the Vanguard S&P 500 Index Fund (VFIAX) charges an expense ratio of 0.04%.

Performance Reality Check

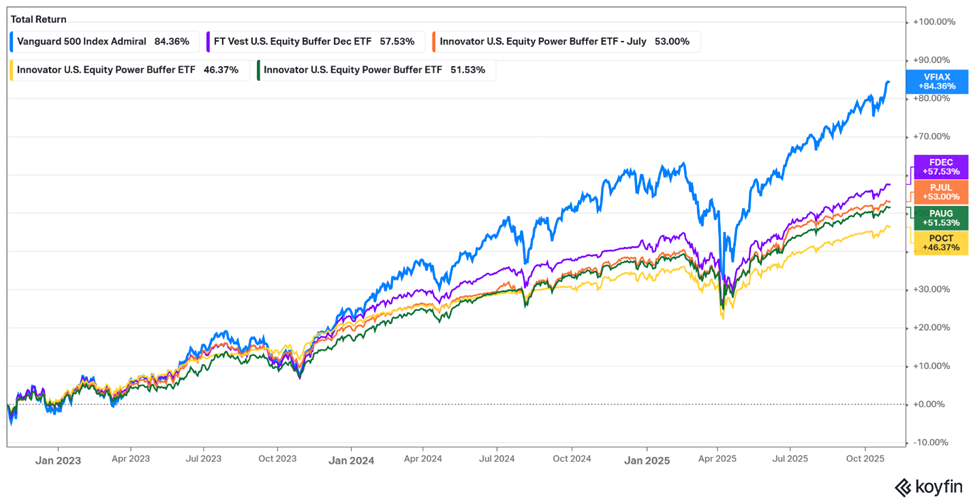

Historical performance comparisons reinforce this point. Over the past three years leading buffered ETF’s have consistently underperformed broad market index funds like the VFIAX.

Note: Past performance is no indication of future results, data recorded from 10/29/2022-10/29/2025

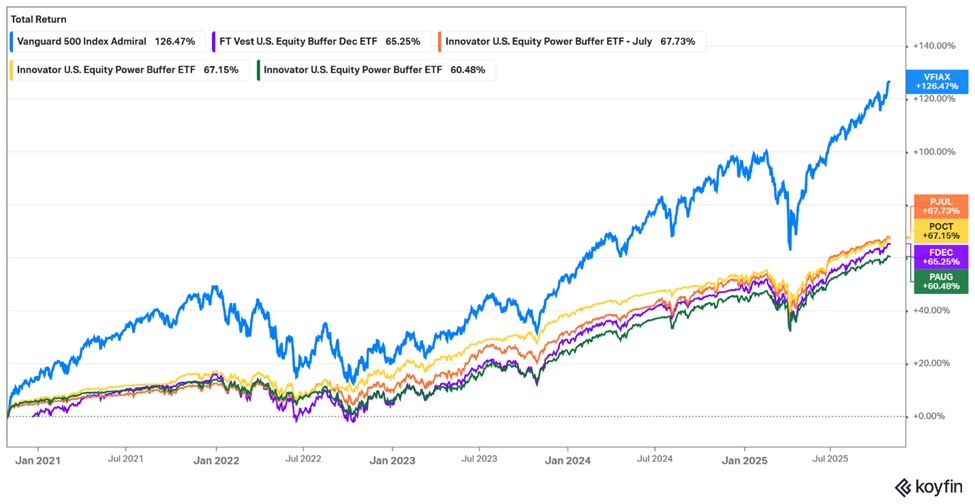

To further emphasize the point if we expand the chart across a 5-year period you see that the return difference is even more dramatic, as capped returns prevent investors from fully participating in bull markets.

Note: past performance is no indication of future results, data recorded from 10/29/2020-10/29/2025

While buffered ETFs may appear to “win” temporarily during short bursts of volatility, the long-term record remains clear: diversified equity exposure continues to deliver superior cumulative returns with far greater simplicity and efficiency. Experts would agree, as Morningstar research analyst Zachary Evens explains in an editorial, “If you’re looking for a particular beta [a level of portfolio volatility], you can achieve much more risk mitigation through just effectively allocating between cheap stock and bond index ETFs.

The Timeless Truth: Risk and Reward are Linked

No good investment is without risk. Markets fluctuate, and temporary declines are part of the investing journey. Buffered ETFs attempt to engineer a way that discomfort – but at the expense of the full compounding power of equities.

At Covington, we believe the most effective protection against market downturns is not a complex derivative product, but rather:

- Broad diversification across asset classes

- Disciplined cash management

- And, most importantly, time in the market

The “boring” strategy of buying and holding quality investments remains, as ever, the most reliable path to long-term wealth creation.

Disclosure

This material is intended for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. All performance data referenced is for illustrative purposes only and is not indicative of future results. Investors should consult with a qualified financial professional before making any investment decision. Covington Investment Advisors, Inc. is a Registered Investment Advisor (RIA). Past performance is not indicative of future returns.

“Buffered ETFs: What Are They and Should You Invest in One?” Kiplinger, Buffered ETFs: What Are They And Should You Invest in One? | Kiplinger

First Trust Portfolios, L.P.. “Summary Prospectus: FT Vest U.S. Equity Buffer ETF – December (FDEC).” Jan. 2 2025. FT Portfolios, www.ftportfolios.com/Common/ContentFileLoader.aspx?ContentGUID=2cb4a38f-08f2-4cd6-8322-01e0016b096d.

Morningstar. “Buffer Funds Are on the Rise, but They May Not Make Sense for Most Investors.” Morningstar, 11 Feb. 2025, www.morningstar.com/funds/buffer-funds-are-rise-they-may-not-make-sense-most-investors

Riddle, Lilly. “The Rise of the Buffer ETF.” The Daily Upside, 25 June 2025, www.thedailyupside.com/etf/investing-strategies-etf/the-rise-of-the-buffer-etf/.