One Big Beautiful Bill Act

How Big is the Beautiful Bill Act?

While tax season has come and gone, taxes remain a key focus here at Covington. We are continuing to monitor portfolio tax implications on a case-by-case basis, and we are constantly planning to best meet our clients' needs. Taxes impact every individual, and our financial planning team at Covington wants to keep everyone up to date on recent changes that may impact your financial plans. This blog should not be construed as tax advice, please consult your tax professional.

It is in this light that we turn to the One Big Beautiful Bill Act (OBBBA) to discuss the implications of your after-tax dollars as you may notice some significant changes in both your retirement plan and statements for your next tax season. Effective Thursday July 24, our financial planning software “Moneyguide Pro” has implemented these changes to the tax law, so we encourage you to reach out if you have any questions on the status of your plans.

It is important to note that this bill is comprehensive with over 800 pages, so we will only begin to explore the key highlights in this blog post. Keeping that in mind, we believe that the topics of discussion today are those that will have the greatest impact on you and your retirement plans.

What Looks the Same?

Federal Income Taxes:

In a Keynesian effort the OBBBA permanently extends the 2017 Tax Cuts and Job Acts tax cuts. This extension comes as the income tax cuts were set to sunset at the end of the calendar year, and resort back to levels prior to 2017. An illustration of those previous rates is shown in the table below.

Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

10% | $0 – $12,200 | $0 – $24,400 | $0 – $17,450 |

15% | $12,200 – $49,600 | $24,400 – $99,200 | $17,450 – $66,400 |

25% | $49,600 – $120,100 | $99,200 – $200,100 | $66,400 – $171,500 |

28% | $120,100 – $250,450 | $200,100 – $304,950 | $171,500 – $277,700 |

33% | $250,450 – $544,550 | $304,950 – $544,550 | $277,700 – $544,550 |

35% | $544,550 – $546,750 | $544,550 – $615,100 | $544,550 – $580,950 |

39.60% | $546,750+ | $615,100+ | $580,950+ |

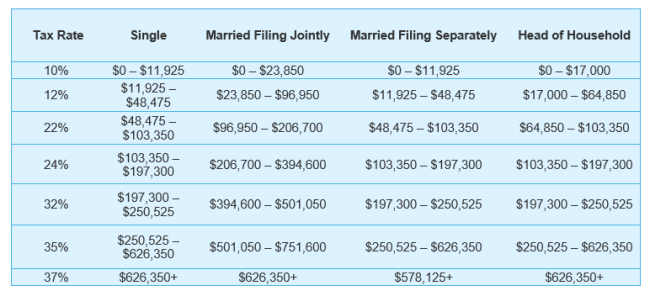

With extension, your federal income tax table will look like this:

Note: these brackets are indexed to inflation and will be adjusted annually

What shows is that the permanent extension of these cuts increases the after-tax income that can now be put into disposable income or investment income for anyone in the 24% bracket and beyond. It is worth noting that these tax brackets have been effective since 2017, so you will not notice any direct changes from this. However, your retirement plans will notice an impact as these rates are now built into our financial planning models here at Covington.

Standard Deduction:

Additionally, the OBBBA permanently increases the Standard deduction to $15,750 for Single Filers, $31,500 for Married Filing Jointly, and $23,625 for Heads of Households. These increases will be indexed to inflation. The increase in Standard deductions means that clients will want to talk to their accounting professional to find out if they should use the Standard deduction or opt for itemized deduction.

Small Business Tax Relief:

Continuing the trend of extending existing policies from the 2017 Tax Cuts and Jobs Act, the Qualified Business income deduction has been permanently extended, posing a major advantage to self-employed individuals operating as sole proprietors, S-Corp owners, and independent contractors. As a reminder that deduction is for 20% of qualified business income.

Estate and Gift Tax Deduction:

Finally, the OBBBA permanently extends the estate and gift tax exemption to $15,000,000 for individuals and $30,000,000 for married couples. This is a substantial benefit as this deduction was set to sunset down to $7,000,000 per individual. Additionally, this exemption will be indexed annually to keep pace with inflation. This will continue to play a significant role in estate planning at Covington as this exemption allows for greater tax deductions when passing your estate along to the next generation, as amounts exceeding the deduction are subject to a 40% tax.

What is Actually New?

The bill promises to deliver more of the same when it comes to federal income, standard deduction, and gift tax structures, so what part of this bill warrants its name? What is big? What is beautiful? Well, there are a couple of additional provisions here that will provide benefit for certain circumstances.

Charitable Giving

Those who participate in charitable giving will most likely encounter the biggest changes from this bill. Additionally, those who are not already involved in routine charitable contributions may now have the incentive to do so. Let’s look at the new provisions and discuss their implications.

For starters those who currently opt for the standard deduction are now eligible to receive an above-the-line deduction for charitable contributions, meaning that on top of your standard deduction, you can receive an additional deduction of $1,000 for single filers, and $2,000 for married couples filing jointly. Note that this provision is only good for Qualified Charitable Donations (QCD’s), and is not applicable to donations to donor advised funds or private non-operating foundations. One final note is that this deduction is not currently indexed for inflation, so this deduction may prove to be less beneficial as time goes on.

For our clients who do itemized deductions there are some important provisions that will change the way you contribute. For starters, the bill implements a floor on deductions for both itemizers and corporations. Meaning that you now must contribute more than 0.5% of your Adjusted Gross Income (AGI), to receive a tax deduction. For example, a couple with $200,000 of AGI will have to contribute more than $1,000 to receive a deduction. Businesses will see a similar but higher floor at 1% of AGI. For those currently using Itemized deductions, we recommend talking to your appointed tax professional to ensure that you are currently planned to contribute enough in the 2026 calendar year to receive the deduction.

Finally, for those in the highest tax brackets, there is a new limit to contributions that you should be made aware of. The new legislation has placed a cap on the tax benefits of itemized charitable deductions at 35% even for members of the 37% tax bracket. More simply high-income filters donating $2,000 would find themselves receiving a $700 dollar deduction, instead of the current $740 deduction. This means that high income earners will want to speak to their tax professionals about the best ways to optimize the timing of their contributions. Particularly for this year, you may want to contribute more this year while you still can. Additionally, once the law is in effect bunching strategies or making larger gifts with less frequency could be more effective strategies.

Non-Profits/Foundations

The OBBBA also changes the previously flat 1.39% tax on a private foundations net investment income, with a progressive rate structure, based on the foundations asset value. As shown below:

Tax Rate | Range |

1.39% | <$50,000,000 |

2.78% | $50,000,000-$250,000,000 |

5.00% | $250,000,000-$5,000,000,000 |

10.00% | >$5,000,000,000 |

This now creates an interesting dilemma for those who have philanthropic aspirations. On one hand those with assets above $50,000,000 could eat these new excise taxes, or they could move the assets into a Donor Advised Fund, which will remain taxed at the flat 1.39% tax rate. On paper this sounds like a no brainer, however there are some considerable tradeoffs to such an action. The biggest tradeoff would be your control. In a Donor Advised Fund, your charitable contributions are usually limited to set list of options that the advisor approves. Meaning that certain charitable aspirations may be left unfulfilled. The second tradeoff would be a long and grueling rollover process requiring new registration, and additional tax filings. The choice though ultimately comes down to your own situation and preferences. We would encourage that you reach out to your trusted tax professionals to learn more about the impact of this new structure. However, If your preference is towards making customizable charitable contributions, a private foundation is still the way to go.

SALT Deductions:

The 47th President made it no secret on the campaign trail that he wanted to lower State and Local Taxes (SALT) across the country, often promising extreme changes to the code. The actual policy is muted but still can help your bottom line. The bill delivers a temporary increased SALT Deduction Cap, going from $10,000 to $40,000 effective from 2025 through 2029. Meaning that the first $40,000 income for individuals will be exempt from state and local taxes, this includes income, property, and sales taxes. The only drawdown is that this exemption is subject to a phase-out which begins at $500,000 modified Adjusted Gross Income (indexed annually). The actual savings from this deduction will vary on a case-by-case basis, so we recommend talking to your preferred tax professional to learn more about if and how this can benefit you.

Family and Education Benefits:

If one thing is clear from this bill, it is that the government believes that the US population is not increasing at a fast enough rate. The bill strongly encourages having children with several provisions. The first exhibit of this is an increase in the Child Tax Care Credit to $2,500/child. This deduction is subject to phase out but in general this means that for any child under the age of seventeen, the taxpayer that the child is dependent on receives a $2,500 tax credit. Meaning that the more kids you have, the greater the deduction. Note that this increased deduction will revert to $2,000 at the end of 2028.

Additionally, the bill makes an effort to improve financial opportunity for young children, with an expanded 529 Plan uses: now allowing for expenses to be directed towards tutoring and caregiving certifications.

The most notable action though is the newly issued Trump Accounts (formerly known as MAGA accounts). At birth, qualifying children will now receive an investment account with a seed of $1,000 with optional parent/ employer contributions. The exact rollout and capabilities of these accounts are still in development, and we wish not to speculate too much on what they are at this time; however, it appears that these accounts will offer parents the chance to give their children a boost when it comes to early education and retirement savings. We will be monitoring the rollout of these accounts closely and will offer more information to clients once we have it.

No tax on Tips and Overtime?

We heard it over one hundred times on the campaign trail, so did the republicans deliver on that promise in the bill? The answer is… sort of. While tips are still subject to tax, the bill introduces a $25,000 deduction. Which will be effective retroactive throughout 2025 and expiring in 2028. Additionally, the bill introduces an overtime deduction of up to $12,500 in qualified overtime premiums from their tax income. Both provisions are subject to a phase out at $150,000 AGI for individuals and $300,000 AGI for Joint Filers.

Our thoughts:

The OBBBA delivers on the “big” part of its name, however whether it proves “beautiful” will come with time. There is still a lot we have not covered in this, like the changes to Social Security, the updated eligibility requirements for Medicaid, and how this affects the Federal Governments balance sheet. Our priority though is to ensure that your plans are up to date. Our financial planning software has been updated to reflect the changes made as a result of this bill. If you have questions about your current plan’s health or would like us to make additional updates, we encourage clients to contact us so that we can offer insights into your individual plan. Additionally, your designated tax professional will be an important source to lean on as these changes to the tax code are put in place.

Sources:

Leahey, Andrew. “No tax on Tips Explained.” Forbes, 20 July 2025

“What Business Leaders Should Know About the One Big Beautiful Bill Act.” CBIZ

“The One Big Beautiful Bill Act Back to House for Approval: Detailed Analysis.” CBIZ

Congress.gov, Library of Congress, accessed 23 July 2025. “H.R. 1 – 119th Congress (2025–2026): One Big Beautiful Bill Act.”

“What Trump’s Big Beautiful Bill Act Means for Seniors.” CBIZ,

“One Big Beautiful Bill (OBBB): Impact on Charitable Giving.” *Fidelity Charitable*, 4 July 2025, www.fidelitycharitable.org/articles/obtaxreform.html.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.