Why do you need a Financial Advisor?

Why do you need a financial advisor? This has become a very popular question across the nation. With the advent of Apps like Robinhood, and the digitalization of broker firms like Charles Schwab, managing a portfolio seems more attainable than ever, giving rise to the self-directed investor – or the so-called “Day Trader.”

This isn’t taboo, the statistics support it. A 2022 Northwestern Mutual study found that while only about 35% of Americans work with a financial advisor, a full 62% say their financial planning needs improvement. This contrast highlights an essential truth: while it’s possible to manage your investments on your own, there are critical areas — from behavioral biases to complex tax and estate strategies — where professional guidance can make a meaningful difference.

Behavioral Finance: Overcoming Emotional Decision-Making

Yes. In theory you could manage your investments yourself, but here is where that becomes a problem, your emotions. This is not a jab at anyone; it is just behavioral finance at work, As Nobel laureate Daniel Kahneman explains in his work on investor psychology, individuals are prone to cognitive biases that can significantly harm investment outcomes. These include overconfidence, hindsight bias, loss aversion, and the ‘hot hand’ fallacy — all of which can lead to poor decisions, particularly during periods of market volatility.

For example, consider an investor who sees a quality company like Apple drop 10% in a single day. A common reaction is to sell out of fear that the stock will continue falling. Yet, over the last decade, Apple’s average annual return has been roughly 25%, illustrating that short-term panic can undermine long-term success. An advisor helps clients adopt what Kahneman calls a ‘broader frame,’ focusing on long-term goals and risk policies rather than day-to-day market noise.

How Advisors Add Value Beyond Investing

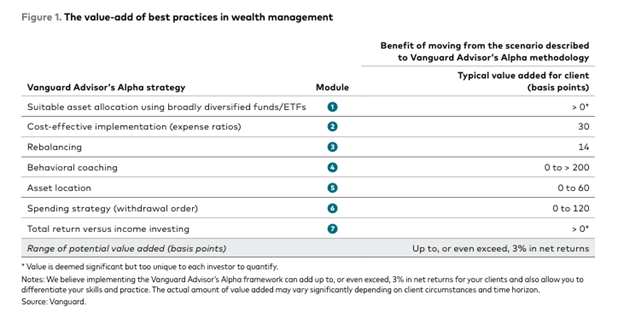

The value of a financial advisor extends well beyond portfolio management. According to Vanguard’s 2022 ‘Advisor Alpha’ study, behavioral coaching alone can add approximately 2% annually to returns by preventing emotionally driven mistakes. Additional value, around 0.6%, can come from tax-efficient strategies and disciplined asset allocation.

But advisors are not merely ‘investment therapists.’ They provide comprehensive planning services that address critical questions investors often overlook: What will my retirement look like? How much will it cost? How do I get there? What changes do I need to make? By answering these questions, advisors help clients clarify goals, develop personalized strategies, and implement plans designed to achieve them.

Planning for Retirement and Beyond

Once a retirement plan is in place, an advisor can design a portfolio tailored to your risk tolerance and long-term objectives. They can also guide you through complex decisions, such as how to withdraw funds in a tax-efficient manner — a strategy that Vanguard estimates can add up to 1.2% annually in retirement income. Over time, the combination of behavioral coaching, disciplined rebalancing, tax-aware strategies, and structured withdrawal plans can potentially enhance net returns by as much as 3% per year. Which is further Illustrated by this table from Vanguard.

Cost vs. Benefit: Understanding Advisor Fees

Of course, professional advice comes at a cost. Most registered investment advisors (RIAs) charge a fee based on a percentage of assets under management (AUM), typically ranging from about 0.80% to 1.25% annually. This fee structure aligns the advisor’s interests with the client’s — when your portfolio grows, so does the advisor’s compensation. This approach is often preferred to commission-based arrangements, which can create conflicts of interest, as advisors may have incentive to sell products that are not suitable to your goals.

Why Now Might Be the Best Time to Start

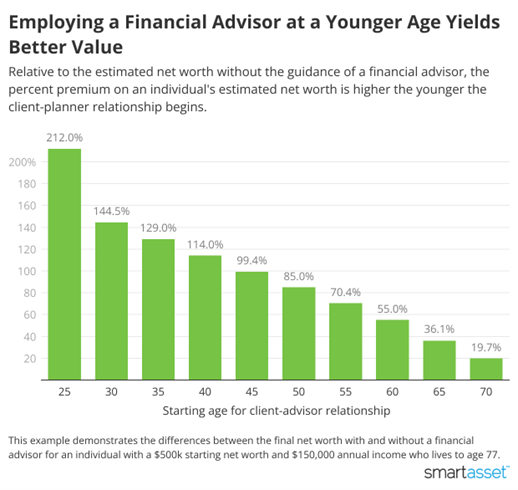

Even if you feel confident managing your finances today, complexity tends to grow as your wealth does. More assets mean more choices — and more opportunities for costly mistakes. Financial Advisors are not just for the super-rich. Establishing a relationship with a trusted advisor early allows them to understand your preferences, risk tolerance, and long-term goals from the start. And because time is one of the most powerful tools in wealth building, the earlier you begin, the greater the potential benefits. This is well illustrated by the following chart from smart asset.com

Final Thoughts

While self-directed investing may work for some, the data show that professional guidance can meaningfully improve financial outcomes over time. From mitigating behavioral biases and optimizing tax strategies to navigating retirement planning and wealth transfer, a financial advisor can serve as both a coach and a strategic partner — helping you make smarter decisions and pursue your long-term goals with confidence.

As always, investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results, and no strategy can ensure success. If you’d like to learn more about how professional advice could support your goals, we welcome you to contact our office.

Kahneman, Daniel, and Mark W. Riepe. "Aspects of Investor Psychology: Beliefs, Preferences, and Biases Investment Advisors Should Know About." Journal of Portfolio Management, vol. 24, no. 4, Summer 1998, pp. 1–21. Institutional Investor, Inc. Reprinted with permission.

Kinniry, Francis M. Jr., Colleen M. Jaconetti, Michael A. DiJoseph, David J. Walker, and Maria C. Quinn. Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha. Vanguard, July 2022,

SmartAsset. “The Minimum Investment for a Financial Advisor.” SmartAsset Insights, 2025, insights.smartasset.com/financial-advisor-minimum-investment.