2025 Holiday Economic FAQs

It's hard to believe we are already at year end. This is a time to reflect on memories made and be grateful for the chance to relax before the new year. But we know what's really on everybody's mind is the economy and markets. So, if you choose to talk shop over the holidays, we are here to give our viewpoints on current events. As always, for each question we give a short and a long answer- depending on how heated the debate is, or if you just want to skip ahead to dessert and gifts. Our 2024 version of this note can be found here.

- So glad you could make it. My holiday budget doesn’t look like it’ll go as far this year. What’s going on with inflation? When will prices come down?

Short answer: The rate of inflation is certainly lower than its peak in 2022. However, inflation will probably remain elevated at around 3%, and prices broadly will not return to pre-covid levels.

Long answer: When it comes to discussing inflation, I feel like there are often two different conversations going on. Inflation in the context of markets, and inflation from the perspective of personal spending. What matters for markets is prices stabilizing enough for policy rates to be eased and corporations to have normalizing supply chains. This has been the case since 2023, resulting in strong equity market returns.

But when it comes to personal spending, inflation is still certainly higher than consumers would like. While the rate of price increases has slowed, price levels have not fallen. What’s more is that most goods are still subconsciously benchmarked against their pre-covid levels. Broadly speaking, prices are not going to return to those levels; from a market perspective, you wouldn’t want them to, as that would indicate a collapse in consumer demand.

Inflation is currently running at around 3% annually. Depending on what measure you use, that’s similar to where we were last year. Tariffs and supply chain disruptions have likely contributed somewhat to inflation remaining elevated - probably explaining a quarter of a percentage point over the last year. The good news is that inflation hasn’t risen as much as many feared after the ‘Liberation Day’ announcement in April. Remarkably, prices are down year-over-year for goods like computers, bicycles, and clothing. So, on balance you will likely not be so happy when doing your Christmas shopping this year. Our forecast is that inflation for next year will likely come in around the same 3% level. The good news is that this inflation is boosted by an overall strong economy, resilient consumer, and a central bank that isn’t completely taking the eggnog away.

So, then what is going to happen with interest rates? Why doesn't the Fed just cut to zero? Wouldn't that turbo charge the economy?

Short answer: Futures markets are currently pricing in two 0.25% rate cuts in 2026. If the Fed cuts rates too much it risks the economy overheating and inflation roaring back past the 2-3% level.

Long Answer. The Fed just announced another 0.25% rate cut at this month's meeting. The catalyst for this cut is a weakening labor market- the second half of the Central Banks dual mandate alongside price stability. The unemployment rate currently sits at 4.6% and for the first time since 2021 there are more unemployed people than job openings. The Federal Reserve Committee felt that it could cut rates to stimulate job growth while not causing prices to rise significantly.

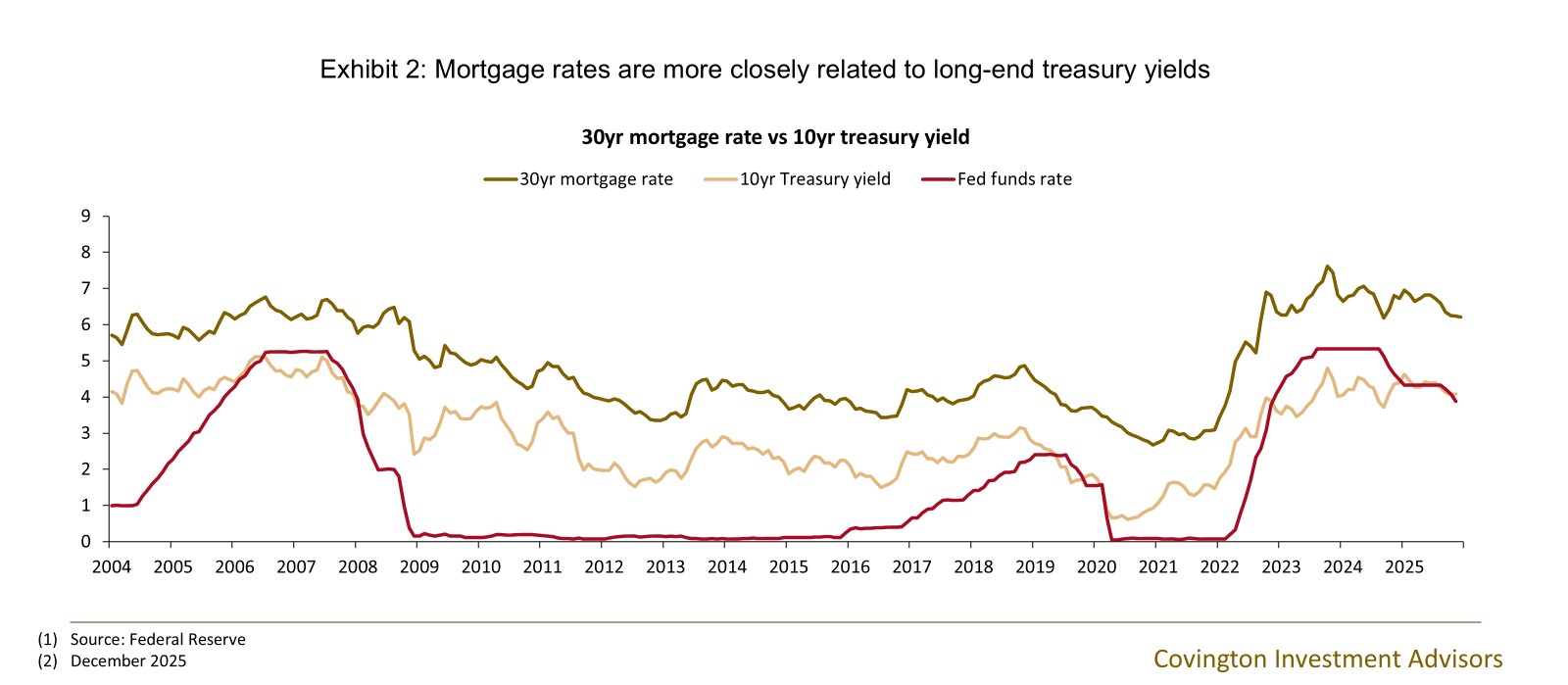

The caveat to interest rate policy is the Central Bank controls short-term rates while long-term rates are largely a function of long-horizon growth and inflation expectations. If the Fed were to cut rates too fast, the 10-year treasury yield might even increase. This dynamic affects the most interest rate sensitive areas of the economy such as housing. 30-year mortgage rates are a long-duration investment and dictated by 10-year yields as opposed to short term rates which are directly controlled by the Fed. Although the Fed has cut rates by 1.50% since last September, the 10-year yield is actually higher since the Fed started cutting. Luckily the mortgage spread (premium of 30-year mortgage rate over 10-year yield) is as low as it's been in nearly four years. As a result, the 30-year mortgage is down 0.50% since the Fed started cutting rates- but not as much as they would’ve liked.

So bottom line before the eggnog kicks in: The Federal Reserve is currently trying to balance cutting rates to stimulate the labor market while wanting to keep inflation at around 2.5-3%. This means they probably cut once or twice next year but unless economic growth widely deteriorates, rates will not be going dramatically lower in 2026 - even as the Fed prepares for a new chairman.

If the labor market is soft, why has my portfolio performed so well?

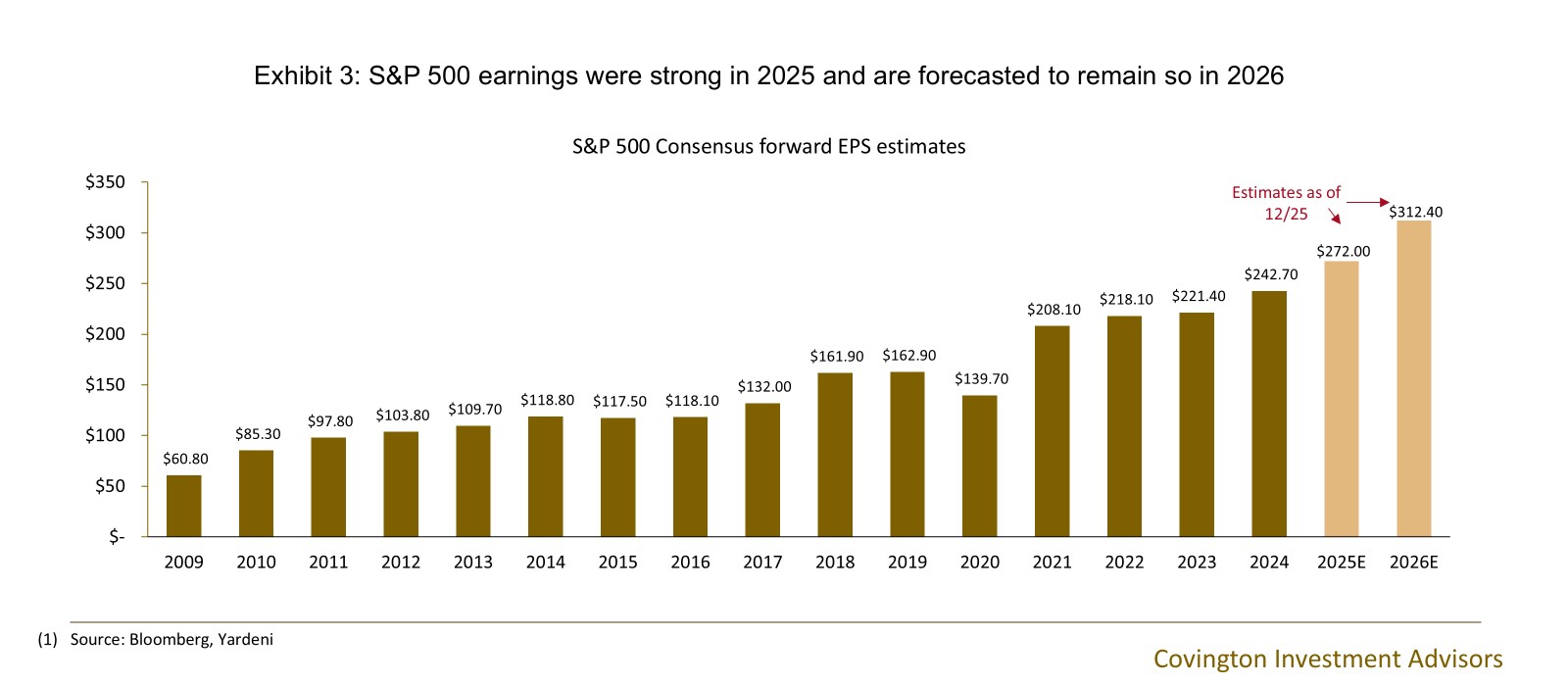

Short answer: The labor market has not yet softened enough to affect large corporate earnings. S&P 500 earnings were strong in 2025 and are forecasted to grow low-double digits again in 2026.

Long answer: Equities have been able to mostly brush off the weakness in the labor market for a few reasons. The first is that the deterioration in job growth has forced the Federal Reserve to cut interest rates, which all else being equal is good for stocks. Second, the labor market has not weakened enough for it to signal a recession. If the unemployment rate were to continue creeping towards 5% , that would start to signal that the economy would have more structural weakness than the consensus view. 2025 has been defined by a notable divergence: while the labor market cooled for the average worker, large-cap corporations remained insulated through high profit margins, AI-driven efficiencies, and a resilient high-income consumer who continues to spend.

One risk is that the economy could experience a negative “wealth effect” shock in 2026 where a downturn in equity markets would hamper consumer spending. The good news is that higher income spending held up surprisingly well after the “Liberation Day” sell off in April of this year. So, it would likely take a more sustained sell-off to cause a sharp deterioration in spending. For right now the underlying economy continues to be in trend line growth with a slightly weakening labor market and easing Fed policy. All things considered, not a bad environment for equities. But as we always say, predicting year-to-year returns of the market is futile. Taking a long-term view is the best approach to investing.

Is Artificial Intelligence (AI) a bubble?

Short answer: The technology of AI is real, and productivity gains in the economy are promising. But there are some pockets of the technology space that show signs of exuberance.

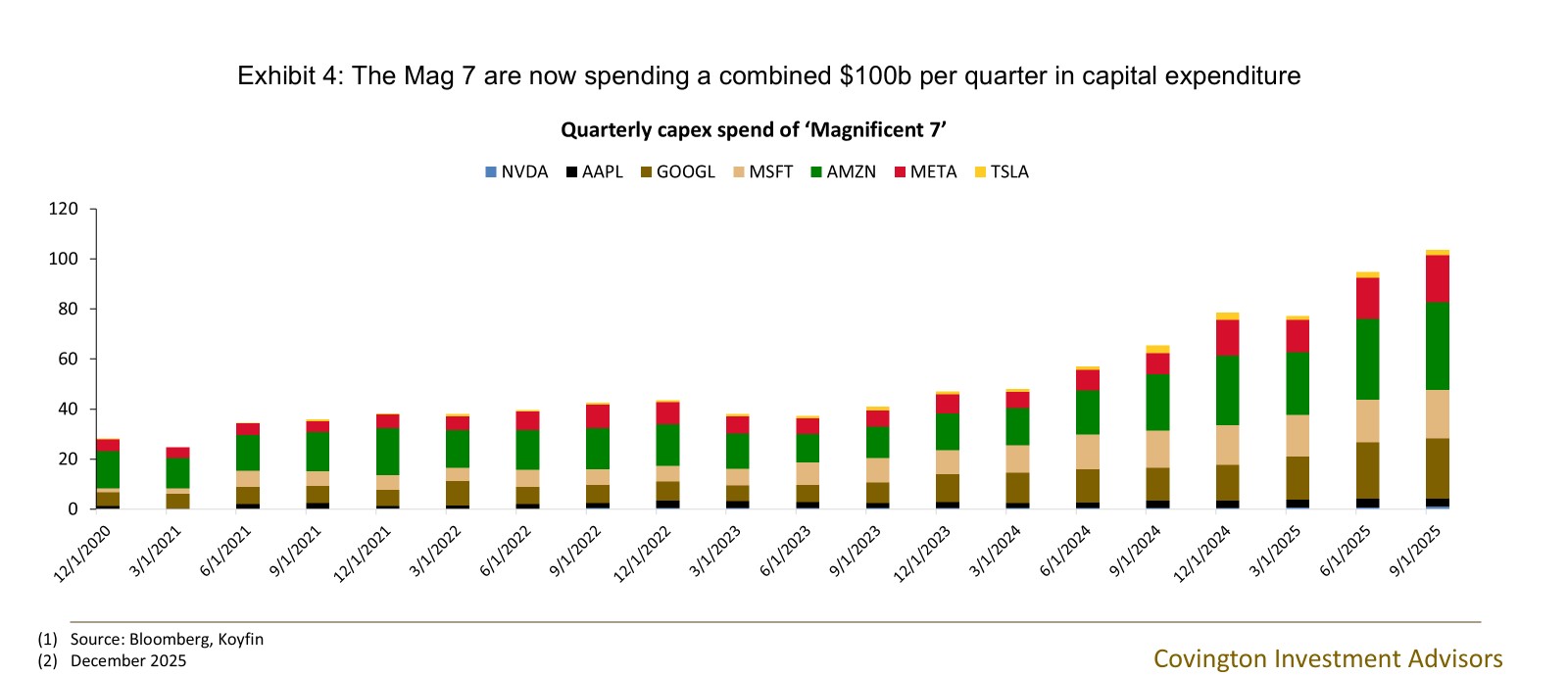

Long Answer: We are currently in the midst of a once-in-a-generation private sector capital expenditure boom as artificial intelligence mania sweeps the world. The four large hyperscalers (Amazon, Microsoft, Meta, Alphabet) are estimated to spend around $400bn this year on capex. For context that is larger than the GDPs of Austria, Norway, and Vietnam.

Capex booms have occurred all throughout economic history often driven by transformative technologies and speculative fever. From 18th century canal building, 19th century gold rushes and railway mania, to more recent real estate and tech bubbles. In the late 18th century canals were the cutting edge infrastructure of their day, akin to laying broadband networks in the last 1990s. Both of these booms eventually experienced speculative busts even though the underlying technology did end up transforming the world.

Fast forward to today and I’m convinced that AI will enhance productivity- especially in sectors such as computer science and health care. However, does that productivity gain warrant the capital being spent? And can we get there without a speculative bust? Its hard for me to picture this massive wave of technology buildout without there being at least some pockets of inefficient capital spend.

The good news is today there are some big disanalogies to the historical capex- led speculative busts I listed. The first is that the companies actually spending these massive sums on chips, data centers, and networking equipment are incredibly profitable. Whereas historical capex bubbles were funded by debt, today’s tech giants are spending this money from earnings (although that could be starting to change). Today’s hyperscalers are spending 60% of their operating cash flows on data centers and other capex. This is far below the 140% spent by telecom companies in 2001. Furthermore, today’s tech giants were incredibly capital light and profitable pre-AI mania. I think the market has not punished them for spending these huge capex sums because it is believed they could turn it off at any moment and not lose competitive edge in their core businesses.

So, to wrap this topic up before the ham is cold: using history as a guide it is reasonable to be cautious of AI capex spending ending in some sort of speculative bust. But due to the profitable nature of the companies involved in today’s spending boom, and fundamental differences between historical analogies, I think the end result will be less systemic. There is also a contrarian aspect where if so many observers are calling something a bubble, it likely is not a bubble - or at least not yet. One thing to be sure of is that the pace of AI adoption and capex spend will again be a factor that moves markets in 2026.

I see tech stocks have led my portfolio again. Why shouldn't I just put my whole portfolio into large cap growth?

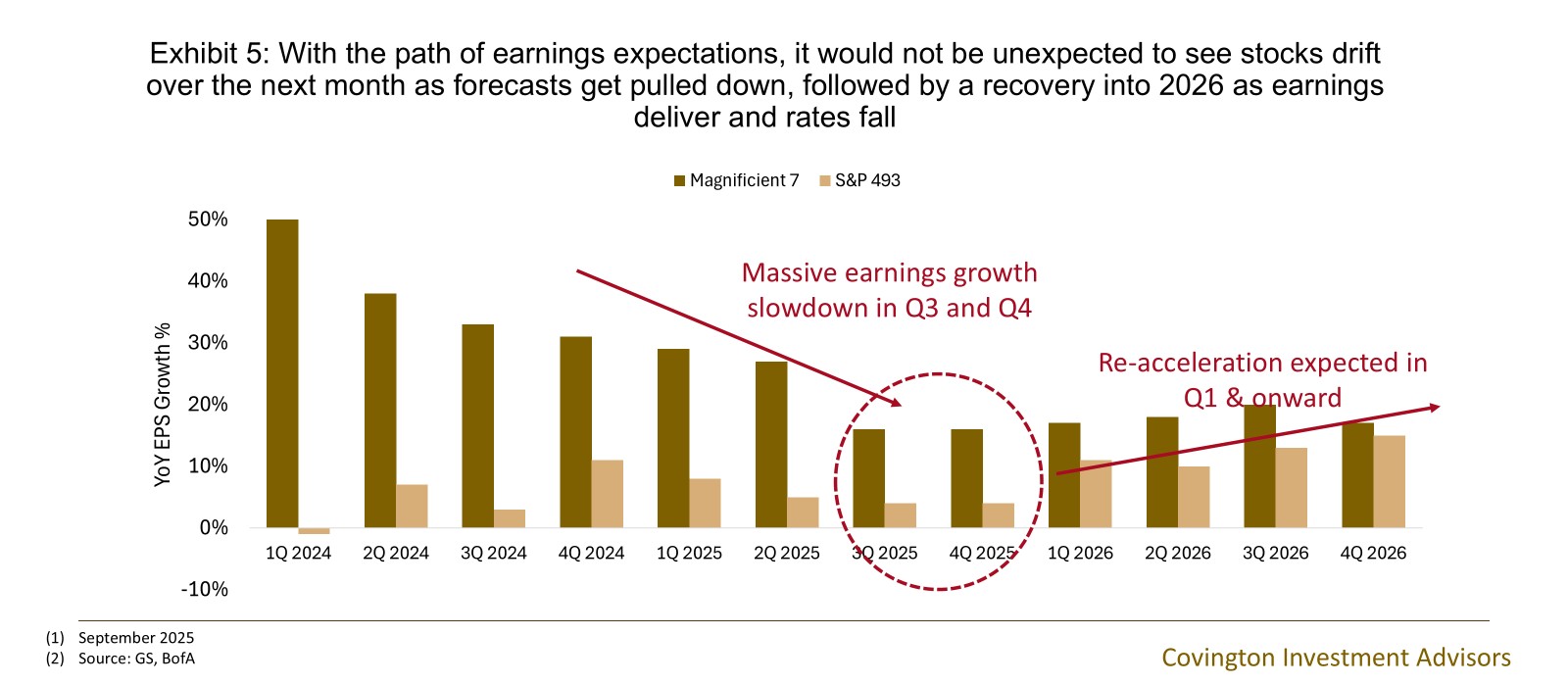

Short answer: Technology stocks have already priced in much of their forward growth expectations. Equity returns by sector are likely to broaden out in 2026.

Long answer: Large cap tech has been the main driver of domestic equity returns. But from here, high growth expectations are already priced into most technology stocks. Furthermore, with the mechanics of year-over-year comparisons, large cap tech stocks are going to decelerate from growing earnings 30+% YoY, to high-teen percentages. Conversely, the S&P 500 ex magnificent 7 is expected to accelerate their earnings growth. This dynamic should result in a broadening out of returns between technology and non-technology sectors.

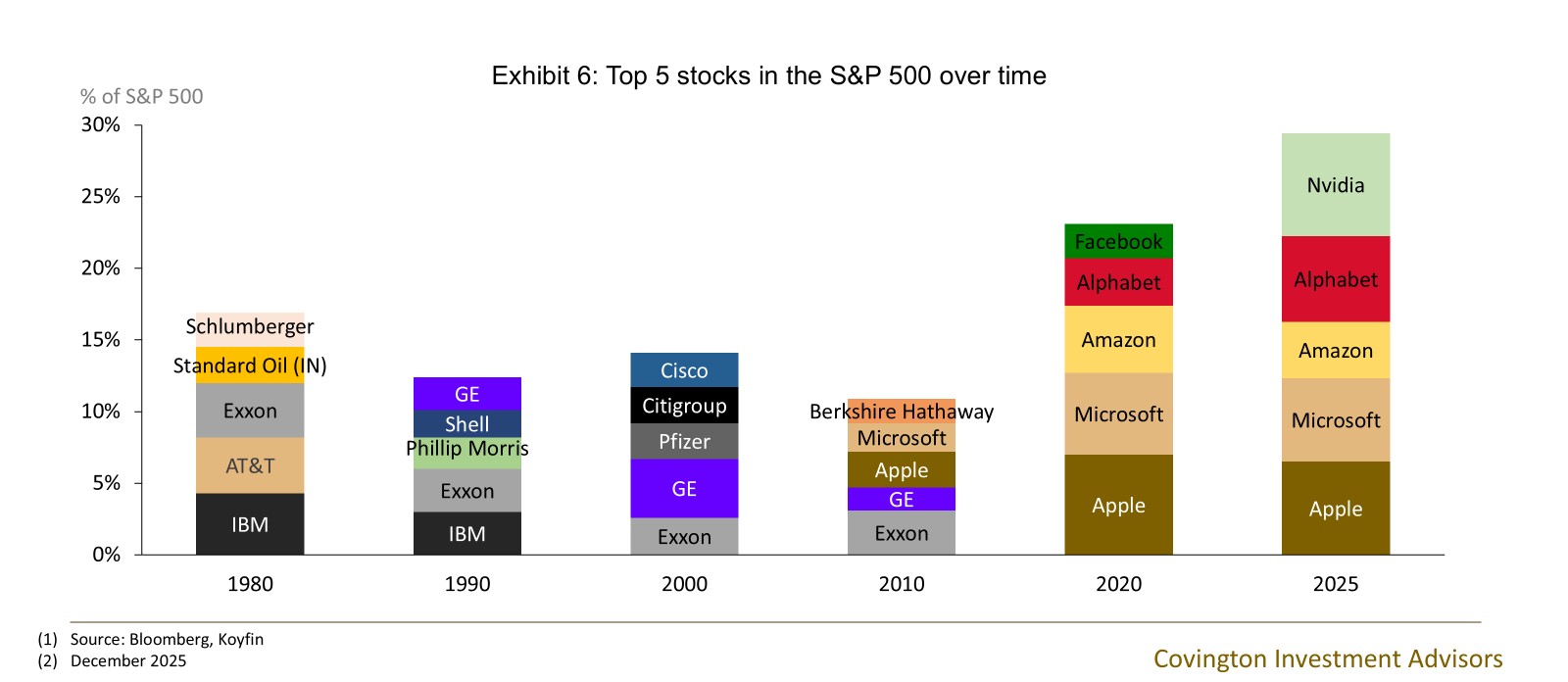

And to build a bit on the answer to the last question. Today’s tech giants are juggernauts. From an investment perspective, they are arguably the most dominant enterprises of the last century, with the exception of maybe the legacy tobacco brands. They have innovative and fast-growing products, pristine balance sheets, strong competitive advantages, and until recently required very little capital investment to grow earnings. But by the nature of capitalism and security pricing, staying on top forever is very difficult. This is especially true in the technology space where today’s market leaders reside. While it's hard to visualize a market not being led by technology after the last five years - history assures us that market regimes will eventually change and taking a diversified approach to equity investing is prudent. After all, trees don’t grow to the sky.

I see you eyeing up the dessert. Before I go, what cryptocurrency or memecoin should I buy for 2026?

Short answer: We think a diversified portfolio of equity investments in cash-flowing enterprises is a better long-term investment approach than gambling on cryptocurrency.

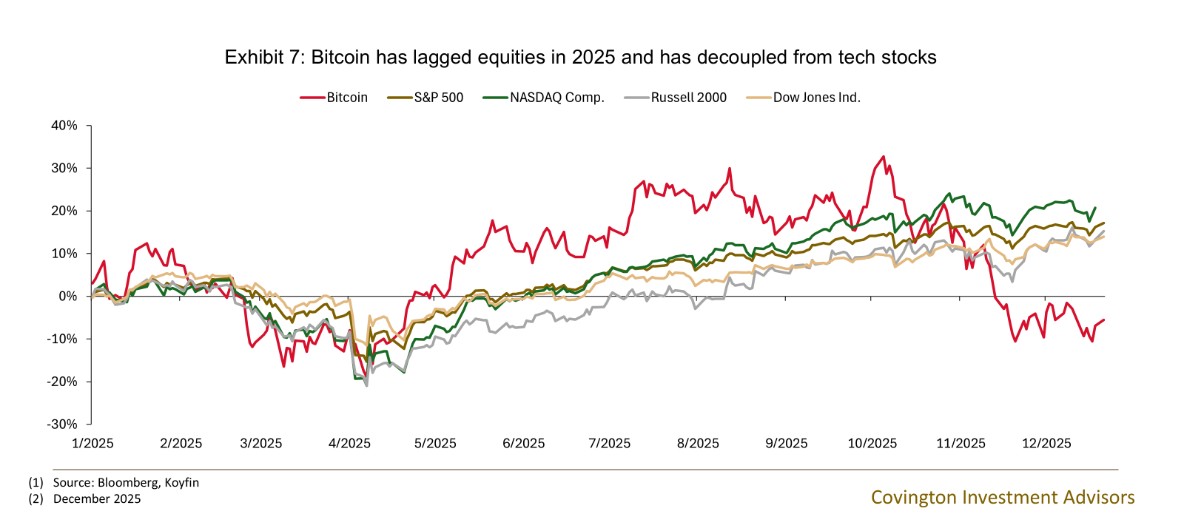

Long answer: It wouldn’t be a holiday note without mentioning cryptocurrency. In the past, conversations around crypto were usually spurred due to the price of bitcoin either spiking or crashing during the year. This year has actually felt like an anomaly whereas of writing this bitcoin has been relatively stable currently down roughly 5% in 2025. What’s more is its returns have decoupled from large cap technology stocks. Could this be a case of the market becoming so large and liquid that its price discovery is becoming more efficient? Possibly… But I’d also guess that the AI mania has taken some of the attention of speculators elsewhere. Either way, this may be a year where cryptocurrency does not come up as a topic of conversation due to its relatively quiet performance.

Nevertheless, our view on crypto has not changed, and I will refer back to our 2024 note on the topic. We still feel that crypto is purely a speculation scheme and should be treated as such, for better or worse. As a fiduciary, we will stick to our investment philosophy of buying cash flowing assets at attractive prices.

I hope this note not only answers some of your questions but also provides some colorful conversation material at your next social gathering. We want to wish you all a Merry Christmas and Happy Holidays and look forward to seeing you in 2026.